Not known Details About Lamina Loans

Wiki Article

The smart Trick of Lamina Loans That Nobody is Talking About

Table of ContentsThe 8-Second Trick For Lamina LoansRumored Buzz on Lamina LoansLamina Loans Fundamentals ExplainedWhat Does Lamina Loans Do?The Ultimate Guide To Lamina LoansGet This Report about Lamina Loans

Loan providers count totally on your creditworthiness, revenue level and amount of present financial obligations when determining whether you're a good candidate. Because the danger is higher for the loan provider, APRs are additionally commonly greater on unsecured lendings (Lamina Loans).

In certain instances, the name or the function of the finance issues. The objective of your financing can establish your prices and also also credit reliability in the eyes of lending institutions. For instance, some lending institutions will certainly offer different individual finance terms based upon the car loan's desired function or provide personal car loans for certain purposes.

Lamina Loans - An Overview

If you are approved, the lender additionally assigns a passion rate to your financing. APRs likewise take costs into account to provide you a better feeling of your finance's complete expense.Compute your estimated funding prices by utilizing this personal finance calculator. Input estimates of the funding quantity, rates of interest and car loan term to obtain a suggestion of your potential payment as well as overall expenses for obtaining an individual lending. Your three-digit credit history plays a huge function in your capability to obtain cash and rack up a favorable rate of interest.

Nevertheless, prequalification is not an assurance that you'll be authorized when you submit a formal application. After prequalifying with a few lenders, compare your lending terms as well as each lender's fees generally, both interest rate and also costs will certainly be shown in the APR. When you've found a lender you would certainly such as to collaborate with, it's time to progress.

The smart Trick of Lamina Loans That Nobody is Talking About

Getting a funding isn't as tough as it used to be, however you can not just apply for a financing anywhere. Your credit i thought about this scores rating issues, and a business that straightens with your situation is best.

Here's every little thing you need to know about finding and using for financings over the internet.

More About Lamina Loans

: Fair, negative Yes: As quick as 1 company day: 0% 8%: $15 or 5% of settlement: 36 or 60 months For extra options, examine out our picks for the ideal personal funding lenders. Quick, hassle-free car loan applications Same-day financing commonly available Flexible and also can be utilized for financial debt combination, overhead, residence enhancements, and also much more Reduced rates than on the internet payday advance Unprotected, so no security is at danger Easy to contrast options as well as visit this website prices Bad-credit go options offered Prices may be more than a safeguarded car loan, such as a residence equity lending Rates might be greater than with your personal bank or lending institution Call for due diligence (cash advance and aggressive loan providers could pose as personal funding lending institutions) The lendings we've pointed out are on-line individual loans, however you need to be cautious of cash advance.

On-line financings make contrast buying simple and also practical. An APR of 5% on a $30,000 funding would suggest you would certainly pay about $1,500 in passion every year to borrow the cash.

You can find out more in our overview to APRs vs. rate of interest rates. Every lending institution fees different charges, such as origination costs, late repayment fees, application charges, and extra. If you're comparing APRs, most of these charges should be represented. Various other fees are not consisted of in the APR, such as late repayment costs or prepayment fines.

The Only Guide for Lamina Loans

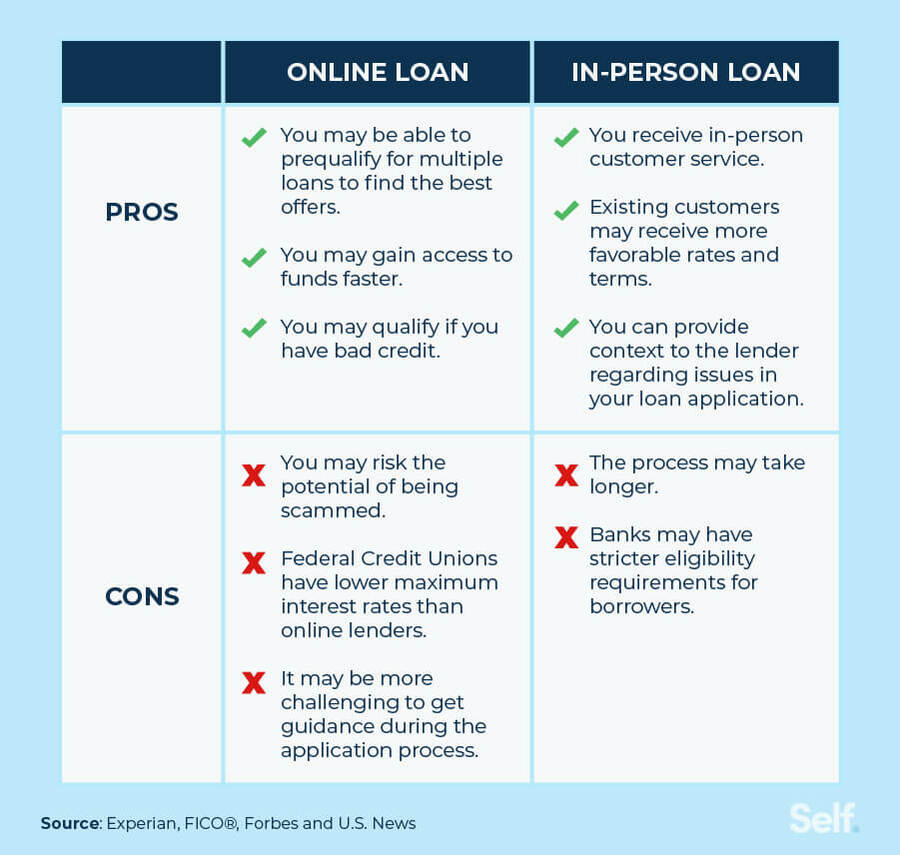

Before you move onward with an on the internet funding, nevertheless, make certain that the financing is risk-free as well as the lender is reputable. Right here are some of the pros and disadvantages of on the internet lendings. Safe on-line finances provide a variety of benefits including: You can use for an on the internet lending at any kind of time from the comfort of your very own home.When you are researching multiple online loans, you'll find it easy to compare the offers you receive. You'll be able to determine which lending is the best option for your specific budget, requires, and also preferences.

The Facts About Lamina Loans Uncovered

Online funding lending institutions often provide pre-approvals. This implies you can figure out whether you're eligible for a financing with a soft credit report questions. Unlike a tough debt questions, a soft credit inquiry will certainly have no result on your debt. All credit degrees are qualified to apply. Even if you have bad or fair credit, you can still obtain authorized for quick secure loans online - Lamina Loans.Report this wiki page